All Categories

Featured

There is no one-size-fits-all when it revives insurance coverage. Obtaining your life insurance strategy right takes into consideration a number of elements. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your hectic life, financial freedom can look like an impossible goal. And retirement may not be top of mind, since it seems up until now away.

Pension, social safety, and whatever they 'd taken care of to conserve. But it's not that very easy today. Less employers are supplying traditional pension and many firms have actually decreased or discontinued their retirement strategies and your ability to rely entirely on social protection is in question. Even if advantages have not been lowered by the time you retire, social protection alone was never planned to be adequate to spend for the lifestyle you desire and should have.

/ wp-end-tag > As part of an audio economic technique, an indexed global life insurance plan can aid

you take on whatever the future brings. Before devoting to indexed universal life insurance coverage, below are some pros and cons to take into consideration. If you select a great indexed global life insurance policy plan, you might see your money worth expand in worth.

Universal Index Annuity

Considering that indexed universal life insurance coverage requires a specific level of risk, insurance policy firms often tend to maintain 6. This type of strategy likewise uses.

Last but not least, if the chosen index does not do well, your cash worth's development will be affected. Normally, the insurance provider has a vested passion in carrying out better than the index11. There is typically a guaranteed minimum interest rate, so your plan's development will not drop below a specific percentage12. These are all elements to be taken into consideration when selecting the ideal kind of life insurance coverage for you.

Indexed Universal Life Insurance Vs Whole Life Insurance

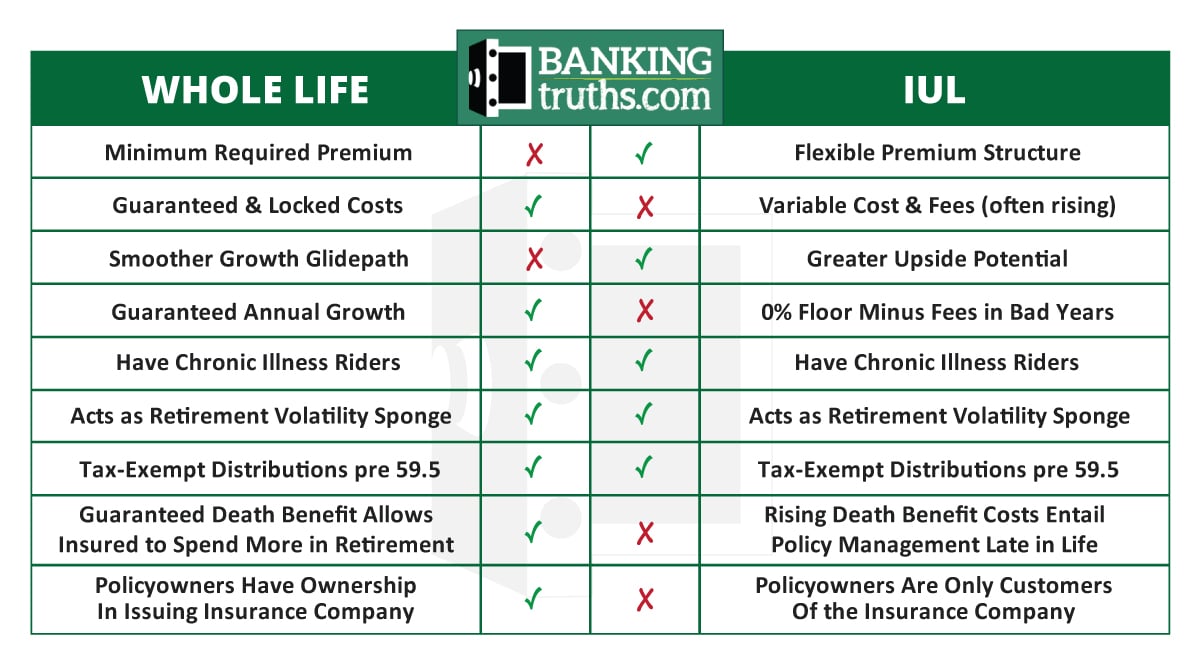

Given that this kind of policy is much more complicated and has an investment component, it can commonly come with greater costs than other policies like whole life or term life insurance policy. If you do not believe indexed universal life insurance coverage is right for you, right here are some alternatives to take into consideration: Term life insurance policy is a temporary policy that normally uses insurance coverage for 10 to thirty years.

When making a decision whether indexed universal life insurance policy is appropriate for you, it is necessary to take into consideration all your options. Whole life insurance policy might be a far better choice if you are trying to find more stability and uniformity. On the various other hand, term life insurance policy might be a much better fit if you just need insurance coverage for a certain amount of time. Indexed global life insurance policy is a type of plan that uses extra control and versatility, together with greater money worth growth possibility. While we do not provide indexed universal life insurance policy, we can provide you with more details about whole and term life insurance coverage plans. We recommend exploring all your alternatives and chatting with an Aflac agent to uncover the most effective fit for you and your household.

The remainder is included in the cash money value of the plan after charges are subtracted. The money value is credited on a regular monthly or annual basis with passion based on boosts in an equity index. While IUL insurance coverage may verify valuable to some, it is necessary to understand how it functions prior to acquiring a policy.

Latest Posts

Accumulator Universal Life Insurance

Cost Of Universal Life Insurance Policy

Best Iul Policies